Discover How to Pick the Right Financial Advisor for Your Future

Are you an individual or couple over the age of 50, planning to retire in the next 10-15 years? If so, you understand the importance of securing your financial future. Choosing the right financial advisor is a crucial step in this process, and working with a local expert in Charlotte, NC, can provide you with unique advantages. We’re here to make that process as straightforward and successful as possible.

Why Choose a Charlotte-Based Financial Planner?

Charlotte, NC, is more than just a thriving financial and business center; it’s a community where personal and professional lives intersect, creating distinct financial needs and goals. A local financial planner understands the intricacies of the Charlotte market, from real estate to local tax implications. By working with a Charlotte-based advisor, you can ensure your financial strategy is not only comprehensive but also tailored to the unique aspects of living and working in the area.

What to Look for in a Financial Advisor in Charlotte

Selecting the right financial advisor in Charlotte involves several key considerations to ensure they meet your individual needs:

Credentials and Experience

- Certifications: Look for an advisor who is CERTIFIED FINANCIAL PLANNER™ (CFP®) or have similar credentials, demonstrating their extensive training and commitment to upholding ethical standards.

- Specialization: Consider an advisor’s specialization, such as retirement planning, wealth management, or tax planning, depending on your specific needs.

- Local Insight: An advisor with experience in the Charlotte financial market can provide you with valuable insights into regional investment opportunities and financial planning strategies.

Personalized Approach

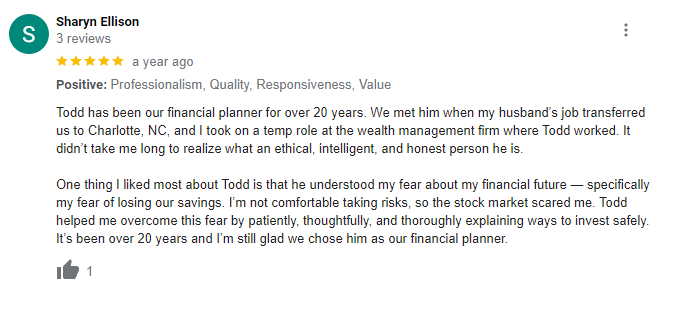

- Understanding Your Goals: A skilled financial planner will take the time to listen to and understand your goals, whether it’s saving for your children’s education, planning for retirement, or building wealth.

- Customized Strategies: Seek out an advisor who tailors their approach based on your financial situation, goals, and risk tolerance, rather than offering generic one-size-fits-all solutions.

Transparency and Trust

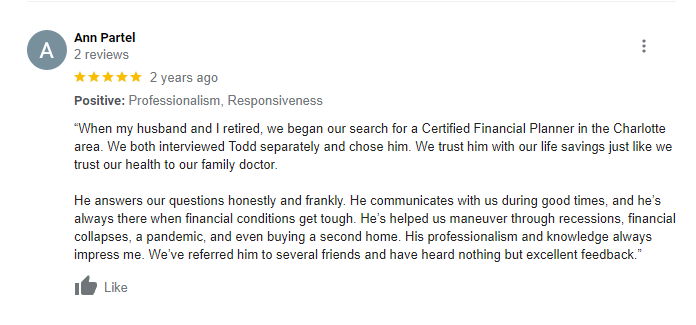

- Clear Communication: Your financial advisor should clearly explain their recommendations, the reasoning behind them, and any associated costs.

- Fee Structure: Understand how your advisor is compensated. Consider working with fee-only planners who don’t earn commissions on product sales, minimizing potential conflicts of interest.

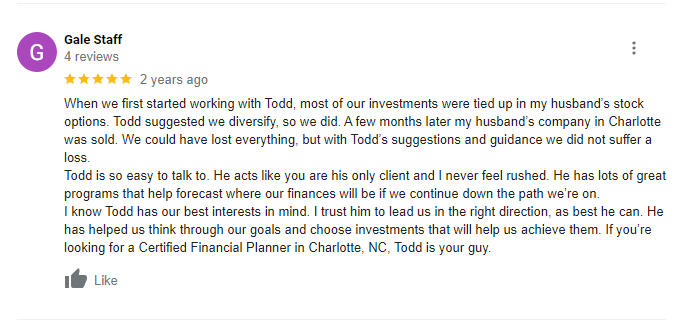

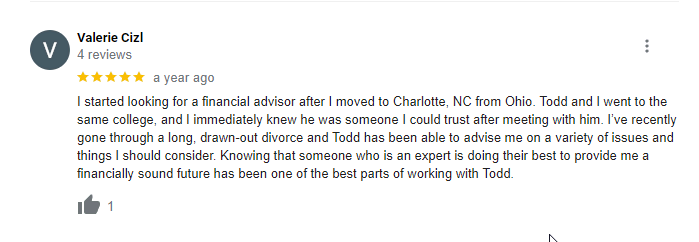

- Trustworthiness: Ultimately, you want a financial planner you can trust. Seek recommendations from friends or family and read reviews from other Charlotte residents to gauge an advisor’s reputation.

The Advantages of Choosing a Fee-Only Financial Advisor

When it comes to securing your financial future, the type of financial advisor you choose can significantly impact your financial planning and investment outcomes. Opting for a fee-only financial advisor offers distinct advantages that prioritize your best interests.

Choosing a fee-only financial advisor offers a clear advantage in aligning your financial goals with the advice you receive. Unlike advisors who earn commissions from selling financial products, fee-only advisors are compensated solely through client fees. This structure promotes unbiased advice focused solely on what’s best for you. The transparency of this model fosters a deeper trust between you and your advisor, as you understand exactly what you’re paying for without worrying about hidden costs or conflicts of interest.

Working with a fee-only advisor also means benefiting from comprehensive financial planning services. They operate under a fiduciary standard, legally obligated to put your interests first. This model encourages a focus on quality advice and asset management rather than product sales, potentially leading to more personalized and effective financial strategies.

In the long run, the fee-only model can be more cost-effective. By eliminating the financial incentive for advisors to recommend specific products, you can potentially lower overall costs and improve net returns on your investments. When you choose a fee-only financial advisor, you’re investing in a transparent, client-first approach to financial planning, setting a solid foundation for your financial future.

Schedule a Consultation

Begin your journey toward financial clarity and security. Contact us today to schedule a brief introductory conversation with a CERTIFIED FINANCIAL PLANNER™ in Charlotte, NC. Together, we’ll craft a financial strategy that aligns with your personal goals and dreams.

Start Planning Your Financial Future Today with a Financial Planner in Charlotte

At Calamita Wealth Management, our commitment to personalized, insightful financial planning makes us a trusted partner for Charlotte residents. Our team of experienced financial planners is ready to help you navigate your financial journey with confidence.

In our no-cost introductory phone call, we’ll discuss:

- Which financial questions do you have?

- What worries you about your financial future?

- What are your concerns or goals when it comes to investing?

- What does your vision of retirement look like?