A SAMPLE FINANCIAL PLAN

By Todd Calamita, CFP®, CDFA®

With a world of information at our fingertips, we can find reviews, price history, product specifications, and more details than we’ll ever need about anything we want to buy. In other words, before making a major purchase, we can arm ourselves with information to make the best choice possible.

While creating a financial plan is in a different category than buying a car or putting an offer on a home, it is just as significant of an investment, and you should know what you are getting before you pay a penny.

Because we develop custom financial plans for each client, it’s no easy task to provide one without working with you extensively. However, we wanted to create something that could help you better understand what your potential financial plan could look like so you can see the benefits a plan could bring to your financial life.

What Does a Financial Plan Include?

First, you may be wondering about what goes into a comprehensive plan. Financial plans often address a myriad of concerns and goals, from college planning to retirement income strategizing. Depending on your needs, your plan may narrow in on one element or address multiple goals you’d like to achieve over time. Whatever you choose to focus on, your financial plan is designed to serve as your road map, helping you navigate the years before, during, and after your transition to retirement. And because financial planning is a lifelong endeavor, we not only help people get started, but walk with them on their journey. When our clients partner with our team, they get an advocate, someone who will help them stay on track and keep a level head when the world, markets, or life go crazy.

We believe a great financial plan should give you a detailed, complete view of your current financial situation, a thorough modeling of where you want to be, and the actions you need to take to reach those goals. It should address all the pieces of your financial puzzle, from stresses and fears to your values and dreams, and include risk factors, cash flow, retirement, estate planning, taxes, education, and income strategies to help bring you guidance.

Your plan should also have flexibility, helping you deal with life’s expected and unexpected circumstances. We call this “The Business Plan for Life,” a process that focuses on cash flow and tax impact, rather than insurance and investments—a plan designed to effectively handle multiple “what if” scenarios at any point in time. We look at everything you own like a business and strive to manage it with the same hands-on scrutiny it takes to run a business successfully.

Start With Goals

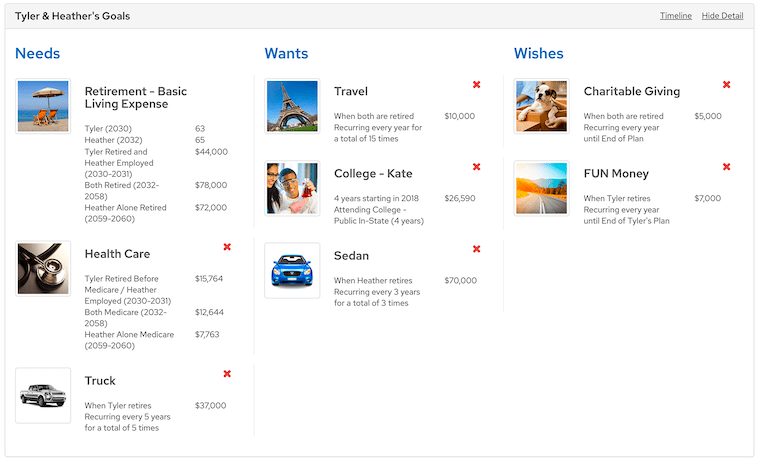

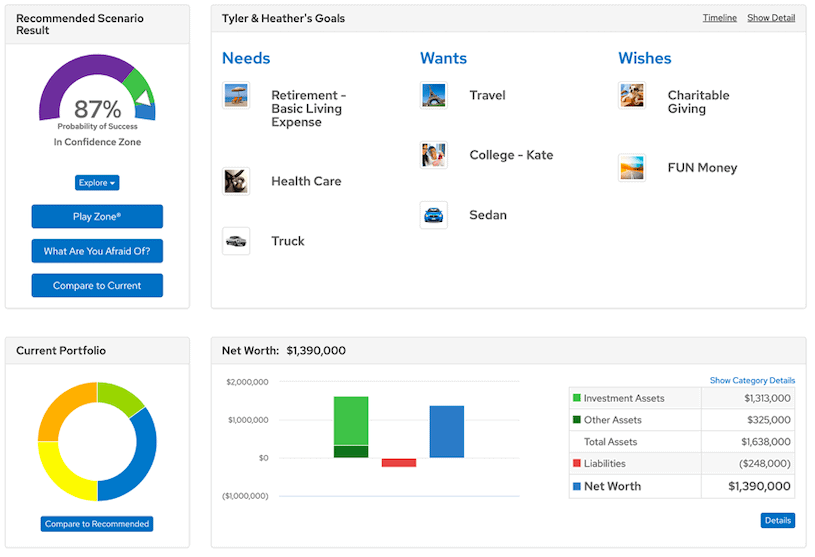

Our financial planning is goals-based. This means we help you develop a spending plan for your future goals and needs—pre- and post-retirement. This approach allows us to more accurately predict your future spending needs and accommodate for how those needs will change over time. Our advanced planning process allows us to bring all these things together in a comprehensive way that makes sense.

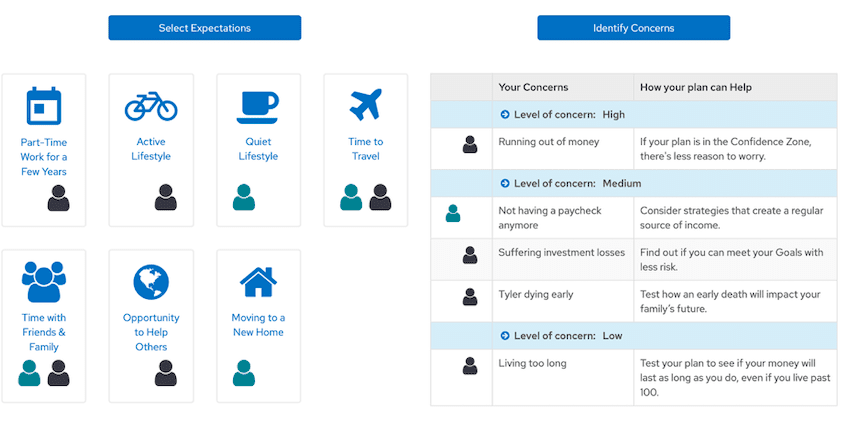

That’s why our first step in our planning process is to get to know you and dig into your goals, dreams, the “why” behind them, and even your concerns and fears. Instead of focusing on saving as much as you can, we endeavor to quantify freedoms—helping you clarify the specific freedoms you want to experience, allowing you to guiltlessly enjoy what you have worked so hard to achieve.

This background provides the foundation for the rest of your plan, making it truly tailored to you, a guide you are motivated to follow. We identify the needs, wants, and wishes that make up your ideal version of a comfortable retirement.

Evaluate Your Resources & Risk

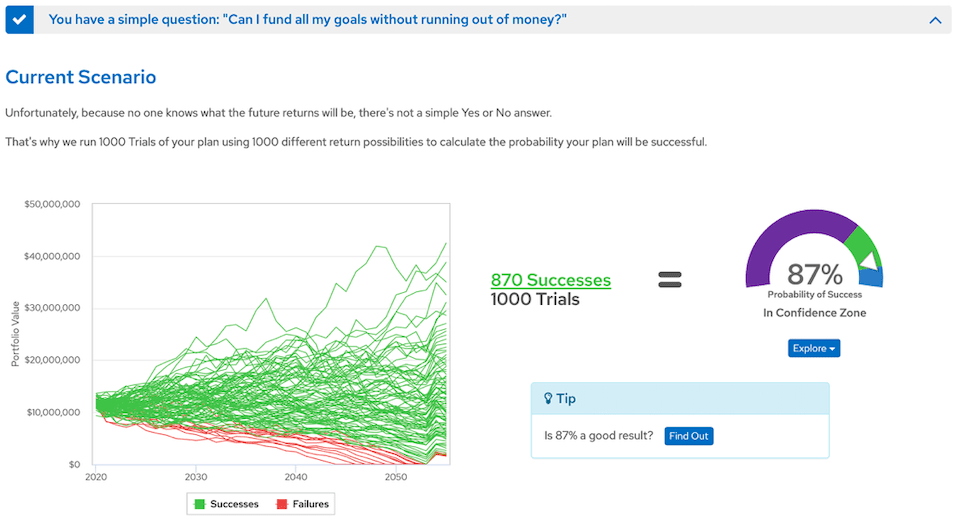

Once we have your goals in place, we analyze the financial resources available to you, such as investments, savings, retirement plans, and Social Security, and run calculations to see if your current financial situation is on track to provide for your goals.

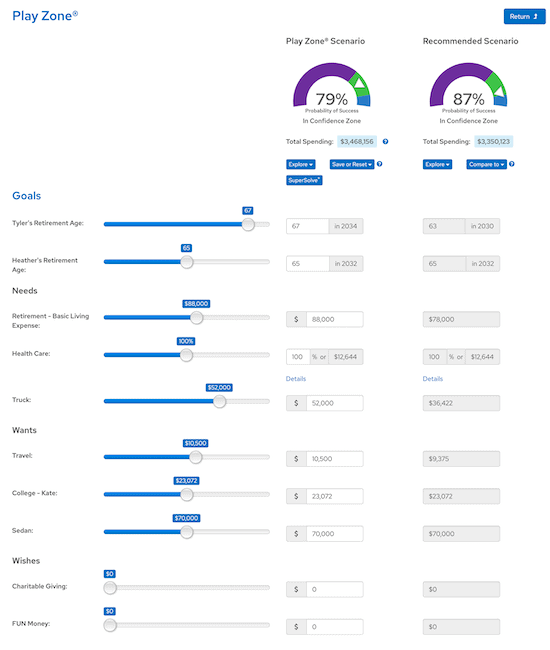

Because the future is uncertain, we run a risk assessment and use a Monte Carlo simulation to test your financial plan. A Monte Carlo simulation runs 1,000 hypothetical simulations of your plan using different, randomized stock market outcomes to determine the probability of success for your plan. We run an initial test based on your current scenario and then collaborate with you to tweak different variables—retirement age, Social Security strategy, goal spending, savings amounts, and others—to come up with a plan that has a high probability of success and feels good to you.

Implement and Move Forward

Once we’ve reviewed and discussed your plan, we implement all the moving pieces, such as establishing a savings strategy and determining an appropriate investment asset allocation. We believe in a strategy of taking a minimal amount of risk that still allows you to reach your goals.

The result is a simple yet powerful blueprint to guide you toward financial freedom.

Get Started on Your Plan!

To get started on your financial plan, schedule an introductory phone call using our online calendar or reach out to us at (704) 276-7325 or todd@calamitawealth.com. Together, let’s find out if we’re the right people for you to depend on during your journey to a comfortable retirement.

About Todd

Todd Calamita is the founder and managing principal of Calamita Wealth Management, an independent, fee-only wealth management company located in Charlotte, NC, serving people locally and across the country, that focuses on providing wealth management solutions to affluent individuals over age 50 and their families. Todd has more than 20 years of experience in the financial services industry and is passionate about helping people have a better life by designing and implementing customized financial plans that bring clarity and confidence. Todd is a CERTIFIED FINANCIAL PLANNER™(CFP®) and CERTIFIED DIVORCE FINANCIAL ANALYST® (CDFA®) and holds a Bachelor of Business Administration from Ohio University and a Master of Business Administration from the Weatherhead School of Management at Case Western Reserve University. He has authored a book, Plan Smart: Conquering 10 Common Money Traps, as well as numerous articles on wide-ranging personal finance topics, from taxes to retirement accounts. He has also been featured in a Financial Boot Camp TV series as a volunteer showing people how to make smart decisions with their money. When he’s not working, you can find Todd spending time with his wife, Teresa, and their two sons, Colin and Cameron. He enjoys rock climbing, swimming, and traveling, and he has a black belt in Tang Soo Do, a Korean martial art. To learn more about Todd, connect with him on LinkedIn.