Helping People Over Age

50 Retire Successfully

REDUCE TAXES - INVEST SMARTER - OPTIMIZE INCOME

Retirement Planning For Individuals Over Age 50 Charlotte, NC

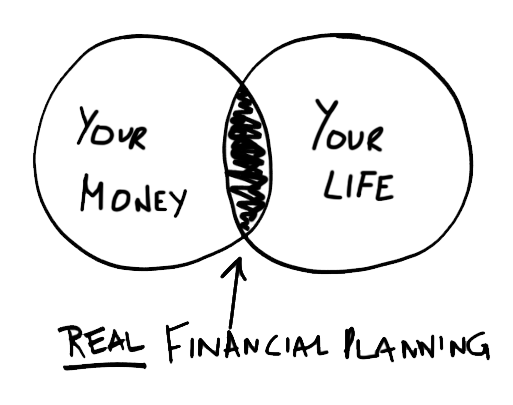

Our mission is to ensure a successful retirement by providing you with effective comprehensive financial planning that is based solely upon what you want your life to be – not what some model says it should be.

Enough about us – now let’s hear about you!

What is a CERTIFIED FINANCIAL PLANNER™ Professional?

Most people think all financial planners are “certified,” but this isn’t true. Just about anyone can use the title “financial planner.” When it comes to your financial security, it’s all about partnering with someone who is committed to putting your interests first. CERTIFIED FINANCIAL PLANNER™ professionals have attained the standard of excellence in financial planning by meeting education, experience and ethical standards.

What are the benefits of working with a CERTIFIED FINANCIAL PLANNER™ professional?

FIDUCIARY

CERTIFIED FINANCIAL PLANNER™ professionals are required to conduct their business under a fiduciary duty, the highest standard of care in the industry.

Education

A CFP® professional must acquire several years of experience related to delivering financial planning services to clients and pass the comprehensive CFP® Certification Exam before they can call themselves a CFP® professional.

Transparency

No Hidden Commissions -– CERTIFIED FINANCIAL PLANNER™ professionals must operate with full transparency with no bias to sell a certain product line or company offering

Only 25% of U.S. financial advisors are CERTIFIED FINANCIAL PLANNER Professionals.*

*Source: www.cfp.net, www.cerulli.com

2024 Wells Fargo Financial Calendar

We are pleased to provide the 2024 Wells Fargo Financial Calendar. This comprehensive calendar is designed to be your essential guide through the financial year of 2024. It offers a detailed roadmap of key financial dates, deadlines, and events, making it an indispensable tool for Wells Fargo employees.

Whether you’re looking to maximize your cash flow, minimize your taxes or preserve and grow your estate, this calendar will serve as your trusted companion. Click below to download your copy and stay ahead in your financial journey.